Latest News and Updates

Stay informed about our initiatives, achievements, and industry engagements that matter to you.

Get In Touch With Our Team

Mandatory*

News & Media Interviews

MetaComp and Stable Join Forces to Redefine Cross-Border Payments with Stablecoins

Partnership integrates StableChain into MetaComp’s StableX™ Network to deliver faster, more transparent, and compliant global fund flows.

Singapore’s MetaComp Raises US$22 Million Pre-A to Scale a Web2.5 Fiat/Stablecoin Hybrid Payment Network for Cross-Border Payments

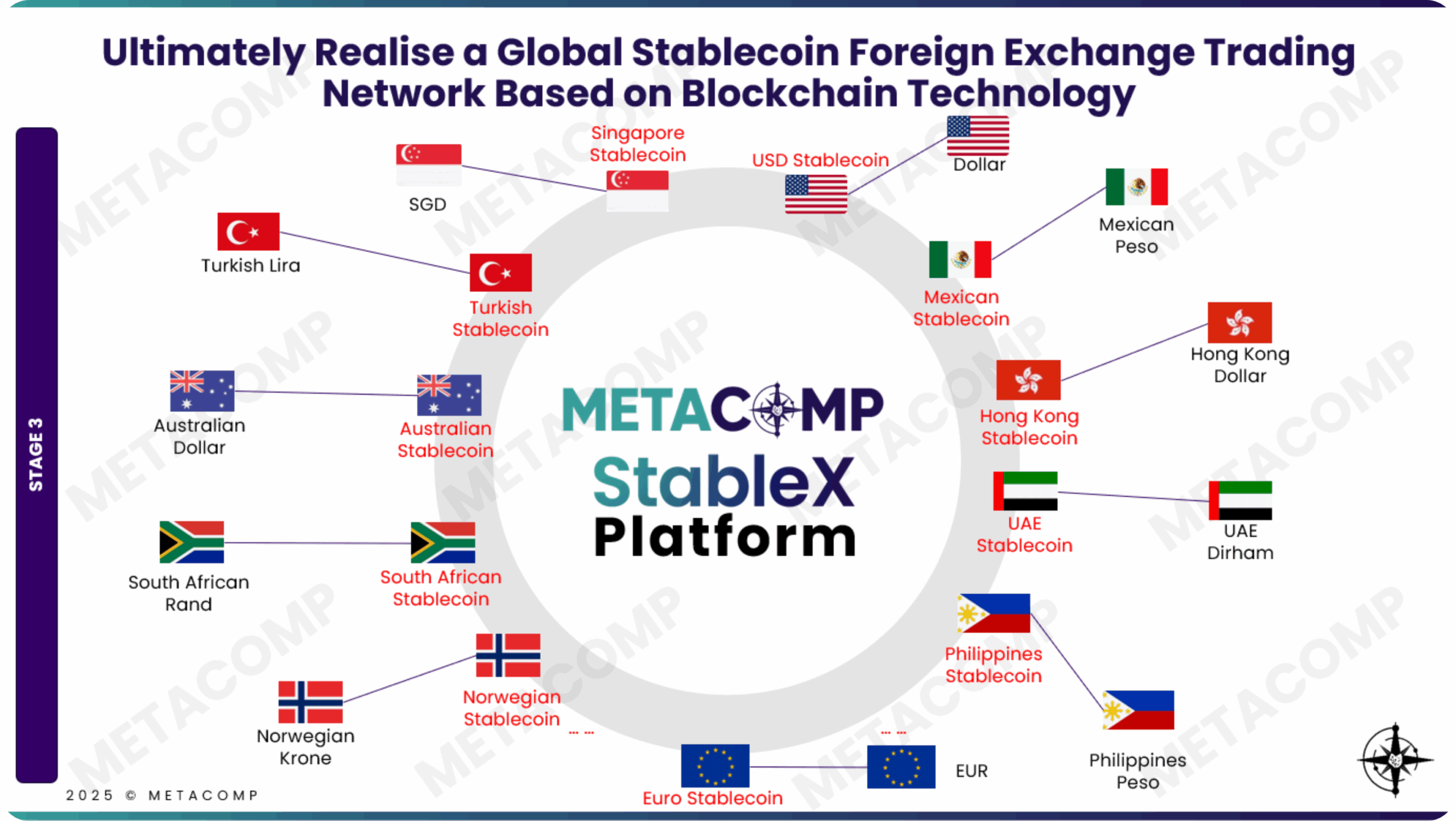

English Traditional Chinese Singapore, 9 December 2025 – MetaComp Pte. Ltd. (“MetaComp”), Singapore’s leading licensed stablecoin cross-border payments and treasury management service provider, today announced it has raised US$22 million in its Pre-A funding round. This is one of the largest Pre-A raises this year for a Singapore-licensed stablecoin payments provider, closing amid a highly selective funding landscape. The raise follows the November launch of StableX Network that comprises its upgraded VisionX risk-intelligence engine, marking MetaComp’s transition into scale-up mode as the region accelerates its shift towards regulated stablecoin settlement. Dr. Bo Bai, Chairman and Co-Founder of MetaComp, said, “Asia is entering a new stage of digital finance where settlement infrastructure must meet the standards of global trade. StableX and VisionX give enterprises the speed of stablecoins with the safeguards of regulated finance. For us, this round goes beyond capital support. It is validation from top-tier investors that regulated stablecoin settlement will be one of Asia’s defining financial rails over the next decade.” The round was backed by Eastern Bell Capital, Noah, Sky9 Capital, Freshwave Fund and Beingboom Capital, with 100Summit Partners as exclusive financial advisor. The investor mix reflects deep expertise in supply chain, fintech infrastructure and institutional wealth management across Asia, underscoring MetaComp’s strategic role in strengthening regional settlement infrastructure. Tin Pei Ling, Co-President of MetaComp, said, “With regulations around stablecoins gaining clarity, enterprises now have the clarity to modernise their settlement processes. Our volumes, now exceeding US$1 billion a month across more than 30 markets, show that businesses want real-time payments that combine speed with compliance. This funding allows us to scale StableX and VisionX across Southeast Asia and build the Web2.5 infrastructure that the region’s digital economy can depend on.” A Web2.5 architecture that unifies SWIFT and stablecoin networks MetaComp holds a Major Payment Institution licence issued by the Monetary Authority of Singapore. With a strong emphasis on compliance, security, and institutional-grade infrastructure, MetaComp delivers an end-to-end suite of regulated digital payment token services, including OTC and exchange trading, on/off-ramp fiat settlement through payment partners, custody of digital tokens, and brokerage activities relating to DPTs. Together with its parent company Alpha Ladder Finance Pte. Ltd., a MAS-licensed Capital Markets Services (CMS) licensee and Recognised Market Operator (RMO), and through its proprietary Client Asset Management Platform (CAMP), MetaComp provides a Web2.5 treasury management services to its payment clients in a secure and integrated environment that bridges traditional finance with digital assets. The StableX Engine, launched in May 2025, is MetaComp’s intelligent FX and liquidity engine designed for cross-border B2B flows. Supporting both traditional SWIFT rails and multiple stablecoin networks, the engine delivers 24/7 FX execution, optimal path routing and automated liquidity management. It currently supports more than 10 leading stablecoins including USDT, USDC, RLUSD, FDUSD, PYUSD and WUSD, with plans to expand to other globally liquid and compliant asset types. The StableX Network builds on this foundation by providing a real-time cross-border settlement layer. Powered by the StableX Engine for FX and liquidity and the VisionX Engine

MetaComp Unveils StableX Network A Regulated Cross-Border Settlement Network that Embeds Risk Intelligence into Real-Time Payments

Singapore, Thursday 13 November 2025 – MetaComp Pte Ltd (MetaComp), the digital payment arm of Alpha Ladder Group Pte Ltd (Alpha Ladder Group) announced the official launch of its StableX Network at the Singapore FinTech Festival (SFF) 2025, marking a new chapter in cross-border finance where compliance, intelligence, and interoperability converge to make payments faster, safer, and smarter. StableX Network is built on MetaComp’s Web2.5 integrated model, representing a milestone in the company’s mission to build a trusted bridge between traditional finance and Web3. At the heart of the StableX Network are two proprietary engines that power its intelligence and efficiency — StableX Engine and VisionX Engine. StableX Engine is the network’s proprietary FX infrastructure and the essential Web 2.5 bridge that enables instant, low-cost liquidity movement. The Engine executes T+0 settlement across all major conversion types — fiat-fiat, fiat-stablecoin, and stablecoin-stablecoin. Leveraging smart programming, it automatically selects the most cost- and time-efficient pathway, whether through traditional SWIFT rails or regulated stablecoin networks. Complementing it is VisionX Engine, MetaComp’s proprietary real-time risk-intelligence system that connects Web2/Fiat monitoring with Web3/Stablecoin/Crypto behavioural analytics, ensuring that bad actors cannot exploit gaps between the two worlds. VisionX Engine continuously screens, scores, and validates every transaction so that instant settlements remain not only fast but fully compliant across both traditional and blockchain rails. As one of the industry’s first unified compliance intelligence systems, VisionX Engine embeds Know-Your-Transaction (KYT) insights directly into the payment flow, delivering the transparency and trust that make real-time payments truly institution-grade. By building this compliant bridge between traditional banking rails and blockchain liquidity pools, MetaComp delivers sophisticated financial engineering that makes complexity invisible to users — keeping the experience instant, transparent, and secure. StableX Network is designed for and with partners of MetaComp, including Banks, Payment Service Providers (PSPs), Stablecoin Issuers, Web3 Institutions, and Database Providers. StableX Network connects regulated financial systems with blockchain-based infrastructure, transforming dormant liquidity into continuous, 24/7 cross-border efficiency — all within institutional-grade compliance frameworks. Bridging the Global Payments Gap — Especially for Payment Service ProvidersGlobal trade continues to expand, projected by the World Trade Organization to exceed USD 33 trillion in 2025, yet cross-border payments remain fragmented and costly. Transactions can take up to two days to clear, with average fees as high as 6.2%, and delays and costs that hit Payment Service Providers and their clients, including small and mid-sized enterprises (SMEs), the hardest. By combining instant settlement, integrated compliance, and Web2.5 interoperability, StableX Network directly addresses these structural inefficiencies, offering PSPs and their clients a smarter, more inclusive way to transact globally. Key features of StableX Network include: StableX Engine – T+0 settlement at a fraction of the cost of traditional cross-border payments Smart Path Selection using both SWIFT and stablecoin rails Built-in regulatory adherence for smooth transactions VisionX Engine – Unified Web 2.5 intelligence linking fiat and crypto for comprehensive compliance monitoring Multi-source KYT engine to unify data and standardize risk Web 2.5 risk engine & dynamic CRR for end-to-end monitoring Shared Intelligence

Veteran Compliance Leader from HSBC, PayPal, ByteDance and Aspire, Appointed as Group Chief Compliance Officer at Alpha Ladder Group to Drive Trusted Digital Finance

Alpha Ladder Group, Singapore’s digital green group and parent company of MetaComp and Alpha Ladder Finance, welcomes Summer Yu, who has recently joined the Group as Group Chief Compliance Officer.

MetaComp and First Digital Sign Strategic Cooperation to Integrate FDUSD into StableX, Advancing Real-World Cross-Border Payments and Compliant Digital Asset Solutions

MetaComp Pte Ltd (MetaComp), a leading licensed cross-border FX and digital assets infrastructure provider headquartered in Singapore and regulated by the Monetary Authority of Singapore (MAS), today released its latest whitepaper, Cross-Border Payments for SMEs: Voices in ASEAN and the Rise of Stablecoins. The paper reveals systemic inefficiencies preventing small and medium enterprises (SMEs) from accessing efficient cross-border payment solutions.

MetaComp Calls for Faster, Fairer Settlement as New Study Reveals USD 6 Trillion SME Payment Opportunity Gap in Cross-Border Finance

MetaComp Pte Ltd (MetaComp), a leading licensed cross-border FX and digital assets infrastructure provider headquartered in Singapore and regulated by the Monetary Authority of Singapore (MAS), today released its latest whitepaper, Cross-Border Payments for SMEs: Voices in ASEAN and the Rise of Stablecoins. The paper reveals systemic inefficiencies preventing small and medium enterprises (SMEs) from accessing efficient cross-border payment solutions.

Featured In